In a groundbreaking move that combines financial innovation with visionary leadership, former Ilocos Sur Governor Luis “Chavit” Singson has officially launched VBank, a fully digital banking platform. This launch signals a bold step into the future of finance, where convenience, accessibility, and innovation take center stage.

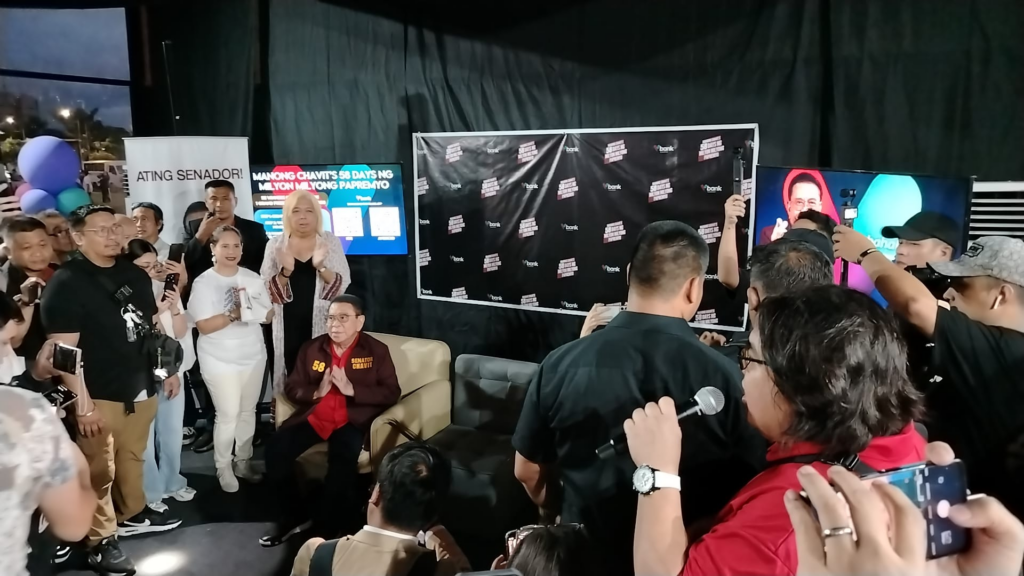

During the Blackout Festival, the launch of VBank started at 3:30 P.M. at the Bridgetowne Destination Estate along Eulogio Rodriguez Jr. Avenue.

A Vision for Modern Banking

Manong Chavit, known for his entrepreneurial acumen and diverse investments, aims to bring banking closer to Filipinos through technology. With VBank, he seeks to eliminate traditional banking barriers, enabling users to access financial services anytime, anywhere. This is particularly impactful in the Philippines, where a large portion of the population remains unbanked or underbanked.

The platform emphasizes inclusivity, aiming to provide Filipinos with access to savings, loans, and other financial tools through a smartphone—a critical step in bridging the gap between rural and urban communities.

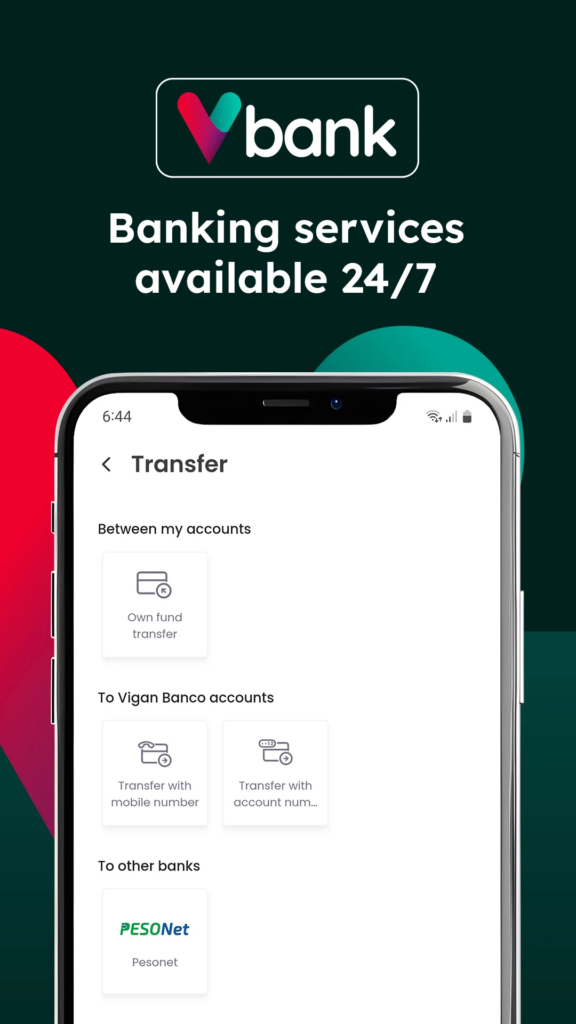

Key Features of VBank

- User-Friendly Interface

VBank boasts a sleek and intuitive design that simplifies banking for users of all tech levels. The app is optimized to cater to a wide demographic, from tech-savvy millennials to seasoned professionals. - Quick Account Setup

Opening an account takes just minutes. With minimal requirements and a seamless process, users can avoid the lengthy queues and paperwork of traditional banking. - Secure Digital Transactions

Security is at the heart of VBank. Equipped with robust encryption and authentication protocols, users can transact with confidence. - Accessible Loans and Savings

The platform offers competitive interest rates for savings accounts and flexible loan options, making it a go-to solution for both personal and business needs. - Empowering the Unbanked

By leveraging digital technology, VBank helps bring financial services to remote areas, where physical banks are often scarce.

Chavit’s Vision for Financial Inclusion

Manong Chavit has always been known for his passion for progress and service. With VBank, he envisions a future where financial literacy and inclusion empower Filipinos to achieve their goals. Speaking at the launch, he emphasized the need for technological advancements to uplift underserved communities.

“This isn’t just a business; this is about giving every Filipino a chance to succeed financially,” Chavit shared during the event.

The Future of Digital Banking in the Philippines

VBank is poised to compete in a rapidly growing fintech landscape, joining the likes of GCash, Maya, and Tonik. However, what sets it apart is the personal commitment of its founder, whose track record of public service and entrepreneurial success inspires trust and confidence.

Event’s Moderator Alwyn Ignacio, VBank Celebrity Ambassador, and Senatorial Aspirant Luis “Chavit” Singson

As digital banking becomes the norm, VBank has the potential to become a transformative tool in the lives of millions. With a leader like Manong Chavit at the helm, the platform promises not just convenience but a real opportunity to make a difference.

The launch of VBank marks an exciting chapter in the Philippine financial sector. By combining cutting-edge technology with Chavit Singson’s innovative leadership, it paves the way for a more inclusive and dynamic banking experience. As Filipinos embrace digital transformation, platforms like VBank will undoubtedly play a vital role in shaping the future of finance.

Whether you’re a seasoned entrepreneur or someone taking their first steps into financial independence, VBank is a platform to watch—and one that could redefine how Filipinos bank.